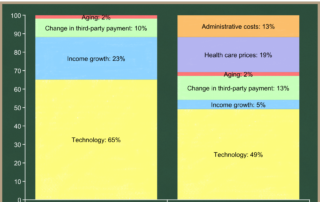

Third party payment in health care (part 3): Technology drives cost growth

Imagine that Sony plans to bring to market a new TV that is twice as good as the old $500 TV but costs $200 more to produce. If instead it is twice as good but costs $2,000 more, they will probably hold off and look for a less expensive way to improve quality.

Now imagine that TV insurance covers 90% of the incremental cost, so the consumer only sees a price increment of $200 for a TV that costs $2,000 more to make. You, and many others, would demand this new TV, which is high quality but probably low value for you, since the true incremental cost is probably more than you’re willing to pay for that quality increase.

Knowing this, Sony will likely make lots of new high-tech TVs, and will expand their R&D programs to push the limits of TV quality improvement. They won’t care much about the higher costs, because demand for any new quality-improving technology is increased by the presence of TV insurance.

This is likely to be true even if you were also told that your TV insurance premium comes out of your wages, because the cost of that insurance depends mostly on how many of your work colleagues buy new and better TVs. In addition, that insurance premium is both hidden to you and distant when you’re at the store buying the TV.

Americans would have the best TVs in the world, and companies would compete based on who can produce the highest quality TVs, almost regardless of cost.

We don’t have TV insurance today, and yet TV quality improves fairly rapidly. The market, as an aggregated collection of individual purchasing preferences, determines a balance of improved quality and high cost that results in “high value technology improvements.” Sony and its competitors try to meet the demand for high value technology improvements, rather than for any technology improvements without regard to cost.

The hidden nature of employer-provided health insurance and the tax subsidy for that insurance distort people’s decisions so that they purchase health insurance with low deductibles and high premiums. This encourages us to use lots of health care without too much regard for the cost of that care.

In her testimony before the Senate Finance Committee, Kate Baicker explained why insurance causes greater consumption of health care:

Insurance, particularly insurance with low cost-sharing, means that patients do not bear the full cost of the health resources they use. … […]