Why high government debt is a problem

The Obama Administration is trumpeting that the budget deficit has been cut by half, “the largest four-year reduction since the demobilization from World War II.” Indeed, CBO projects the deficit this year will be 3 percent, maybe dropping a few tenths over the next few years before beginning an inexorable climb driven by demographics, health cost growth, and unsustainable entitlement benefit promises to seniors. If you listen to the President, our only problem is that future one and that’s a few years off. Now that deficits have come down, he says we’re OK for the time being. Deficits around 3 percent will hold debt constant relative to the size of the U.S. economy, and he appears to think that’s fine.

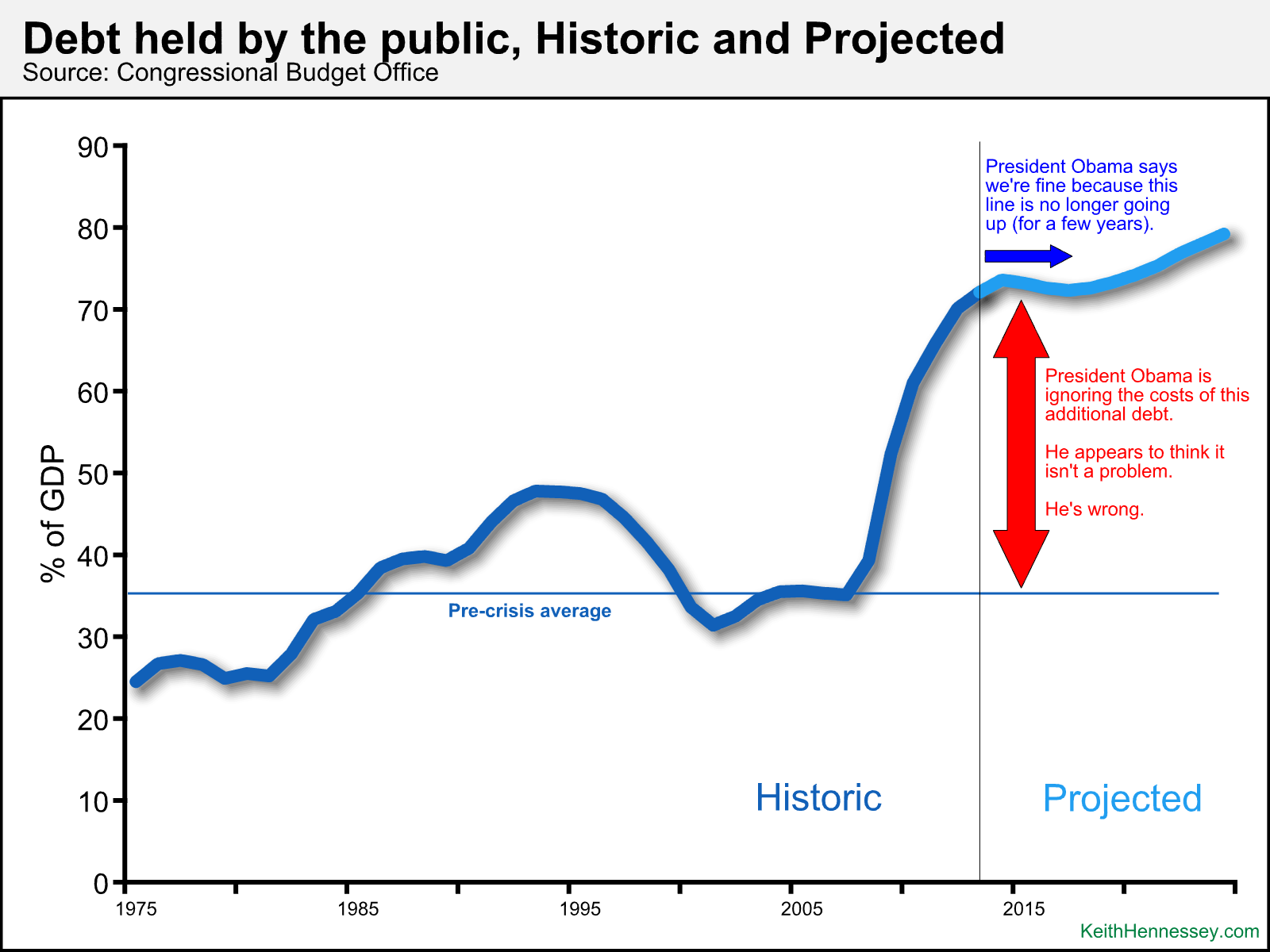

I don’t. Look at this graph from CBO.

In their recently released annual Economic and Budget Outlook CBO lays out the four costs of higher debt (page 7).

- “Federal spending on interest payments will increase substantially as interest rates rise to more typical levels;”

- “Because federal borrowing generally reduces national saving, the capital stock and wages will be smaller than if debt was lower;”

- “Lawmakers would have less flexibility … to respond to unanticipated challenges;”

- “A large debt poses a greater risk of precipitating a fiscal crisis, during which investors would lose so much confidence in the government’s ability to manage its budget that the government would be unable to borrow at affordable rates.”

CBO attributes these damaging effects to “high and rising debt,” and doesn’t distinguish between high (where we are now, in the mid 70s as a share of GDP) and future entitlement spending-driven growth. The same logic applies both to today’s high debt and to future even higher debt. These are real and significant costs we are bearing today.

It’s obvious that we can’t allow debt to increase forever as it will begin to do a few years from now but there’s an additional important question that is being largely ignored. Momentarily setting aside future projected debt growth, is debt/GDP in the mid-70s acceptable? Should the goal be to not let the problem get worse, or both to solve the future debt growth and, over time, to reduce debt/GDP to be closer to the historic pre-crisis average?

CBO has done policymakers a great service by explaining these four costs of high and […]