For every working American

I’ll let President Obama’s words and CBO’s analyses speak for themselves.

THE PRESIDENT: … that has jeopardized middle-class America’s basic bargain — that if you work hard, you have a chance to get ahead.

I believe this is the defining challenge of our time: Making sure our economy works for every working American. It’s why I ran for President. It was at the center of last year’s campaign. It drives everything I do in this office.

Source: President Barack Obama, Remarks by the President on Economic Mobility (The ARC, Washington, DC, December 4, 2013.)

CBO: Once fully implemented in the second half of 2015, the $10.10 option would reduce total employment by about 500,000 workers, or 0.3 percent, CBO projects.

Source: Congressional Budget Office, The Effects of a Minimum-Wage Increase on Employment and Family Income (February 18, 2014) Summary, page 1

CBO: The reduction in CBO’s projections of hours worked represents a decline in the number of full-time-equivalent workers for about 2.0 million in 2017, rising to about 2.5 million in 2024.

Source: Congressional Budget Office, The Budget and Economic Outlook: 2014 to 2024, Appendix C, “The Labor Market Effects of the Affordable Care Act: Updated Estimates” (February 2014) page 117.

CBO: About one-tenth of a percentage point is attributable to the incentives generated in 2013 by extensions of UI benefits (from the usual 26 weeks to as much as 99 weeks), primarily because the program’s rules led some people to remain in the labor force and to continue to search for work in order to remain eligible.

Source: Congressional Budget Office, The Slow Recovery of the Labor Market (February 2014) page 8.

THE PRESIDENT: So our job is to not only get the economy growing but also to reverse these trends and make sure that everybody can succeed. We’ve got to build an economy that works for everybody, not just the fortunate few. Opportunity for all — that’s the essence of America. No matter who you are, no matter where you come from, no matter how you start out, if you’re willing to work hard and take responsibility, you can succeed.

Source: President Barack Obama, Remarks by the President on Fuel Efficiency Standards of Medium and Heavy-Duty Vehicles (Safeway Distribution Center, Upper Marlboro, Maryland, February 18, 2014).

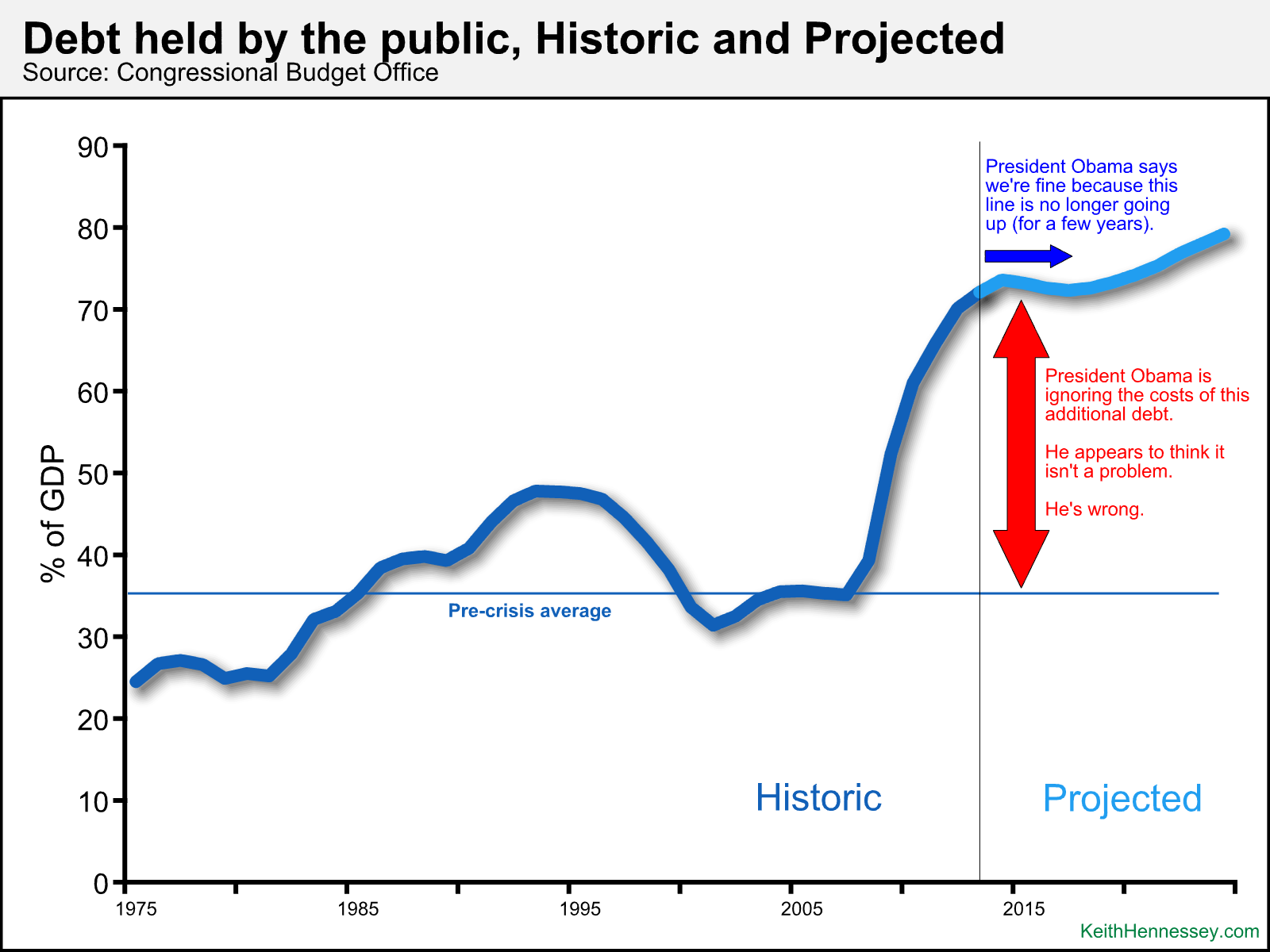

Why high government debt is a problem

The Obama Administration is trumpeting that the budget deficit has been cut by half, “the largest four-year reduction since the demobilization from World War II.” Indeed, CBO projects the deficit this year will be 3 percent, maybe dropping a few tenths over the next few years before beginning an inexorable climb driven by demographics, health cost growth, and unsustainable entitlement benefit promises to seniors. If you listen to the President, our only problem is that future one and that’s a few years off. Now that deficits have come down, he says we’re OK for the time being. Deficits around 3 percent will hold debt constant relative to the size of the U.S. economy, and he appears to think that’s fine.

I don’t. Look at this graph from CBO.

In their recently released annual Economic and Budget Outlook CBO lays out the four costs of higher debt (page 7).

- “Federal spending on interest payments will increase substantially as interest rates rise to more typical levels;”

- “Because federal borrowing generally reduces national saving, the capital stock and wages will be smaller than if debt was lower;”

- “Lawmakers would have less flexibility … to respond to unanticipated challenges;”

- “A large debt poses a greater risk of precipitating a fiscal crisis, during which investors would lose so much confidence in the government’s ability to manage its budget that the government would be unable to borrow at affordable rates.”

CBO attributes these damaging effects to “high and rising debt,” and doesn’t distinguish between high (where we are now, in the mid 70s as a share of GDP) and future entitlement spending-driven growth. The same logic applies both to today’s high debt and to future even higher debt. These are real and significant costs we are bearing today.

It’s obvious that we can’t allow debt to increase forever as it will begin to do a few years from now but there’s an additional important question that is being largely ignored. Momentarily setting aside future projected debt growth, is debt/GDP in the mid-70s acceptable? Should the goal be to not let the problem get worse, or both to solve the future debt growth and, over time, to reduce debt/GDP to be closer to the historic pre-crisis average?

CBO has done policymakers a great service by explaining these four costs of high and rising debt, and I wish more members of Congress understood them and talked about them. This is important enough that it’s worth the time to understand it well. You can find a slightly expanded version from CBO on pages 9 and 10 here.

I want to expand a bit on CBO’s points. I’ll take them in reverse order and start with the last one, the increased risk of a fiscal crisis. Those on the left who argue that high debt isn’t a problem like to (a) pretend that this increased risk is the only consequence of high debt, and then (b) dispute that the higher risk is significant enough to cause concern. I worry that when the U.S. has doubled its debt/GDP in five years, and when our future debt path looks like it does, that the risk of a fiscal crisis is significant. But this risk is unknowable, and even if we could somehow measure this risk, we can never know when that crisis would occur. My stronger arguments are (1) fiscal crisis risk is undoubtedly higher at a higher debt level; (2) the risk is only going to increase on our current path as debt increases; and (3) there are three other costs to higher debt, so even if you’re not worried about crisis risk, you need to address those other costs.

Moving up the list we get to CBO’s “less flexibility” point. CBO’s projected debt path assumes a (very) slow but basically steady return to macroeconomic health. If we have another recession, terrorist attack, or war, the numbers will be worse, and whatever increased government spending or fiscal stimulus we will then need will be initiated from a much weaker starting point (a much higher level of debt). Because our debt is so high we are poorly prepared to address future risks that require significant short-term deficit spending or tax relief.

Then we get to the cost with the greatest political impact: lower future wages. This is really a cost of the big recent deficits that resulted in today’s higher debt, and an additional cost of projected future deficit growth. The reduced national saving caused by big deficits leads to a smaller capital stock. This lowers productivity and therefore wages. To reduce our public debt government would have to save more (or even, perish the thought, balance the budget), leading to higher national saving, a bigger capital stock, higher productivity and higher future wages. To be politically crass: lower government debt means more shiny new factories with high wage American jobs. I’m willing to sacrifice quite a lot of government spending in exchange for higher future wages.

Finally, the item at the top of CBO’s list is the one most likely to drive Congressional action. Our government debt is now 37 percentage points above its pre-crisis average, but government interest payments are relatively low because interest rates are low because the short-term economy is still weak. When the economy eventually recovers and the government debt rolls over, that additional debt is going to increase government net interest payments by about 1.85 percent of GDP (37% X CBO’s 5% 10-year Treasury rate). Relative to the rest of the federal budget, 1.85% of GDP is enormous. That increased interest cost is as much as the federal government will spend this year on all military personnel (uniformed + civilian) plus all science, space, and technology research plus all spending on the environment, conservation, national parks, and natural resources plus all spending on highways, airports, bridges, and all other transportation infrastructure. Higher debt means higher interest costs which will squeeze out spending for other things that government does. It will also increase pressure to raise taxes even further.

Government debt is twice as large a share of the economy as it was before the financial crisis. In addition to increasing the risk of another catastrophic financial crisis, high government debt squeezes out other functions of government, creates pressure for higher taxes, leaves policymakers less able to respond to future recessions, wars, and terrorist attacks, and lowers future wage growth. This problem will only increase as entitlement spending growth kicks into high gear a few years from now, but simply stabilizing debt/GDP in the mid 70s is an insufficient goal. Don’t rest on your laurels because deficits are smaller than they used to be. High government debt is a big problem.

Response to Senator Cruz on the debt limit

On the Mark Levin show Thursday Senator Ted Cruz said:

The single thing that Republican politicians hate and fear the most, and that is when they’re forced to tell the truth. It makes their heads explode. And actually look, this debt ceiling example is a perfect example. The Republican members of the Senate, they all wanted the perfect show vote. So the whole fight was, was every Senator in the Senate going to consent to allow a clean debt ceiling, to allow Barack Obama to get a blank check to raise our debt, while doing nothing about spending, with just 51 votes? Now in order for that to happen, all 100 Senators have to consent to it. Now there were an awful lot of Republican Senators who thought that was perfect, cause then they could all vote no, and go home and tell their constituents, “See, I voted no, I did the right thing.” But it only happens if they allow it to happen. And all I did was very simple, I said, listen, when I told Texans when I ran for office, that I’m going to fight with every ounce of strength I have to try to help pull this country back from the fiscal and economic cliff, I wasn’t lying to them, I meant it. So if your ask of me is will I consent to let Harry Reid to do this on 51 votes, the answer is no. I will vote no at every stage against it, because it’s irresponsible, because it’s wrong, because we’re bankrupting our children. And Republicans’ heads exploded, because it meant … Look, make no mistake about it. This was their desired outcome. An awful lot of Republicans wanted exactly what Barack Obama wanted, exactly what Nancy Pelosi wanted, exactly what Harry Reid wanted, which is to raise the debt ceiling, but they wanted to be able to tell what they view as their foolish, gullible constituents back home they didn’t do it, and they’re made because by refusing to consent to that they had to come out in the open and admit what they’re doing and nothing upsets them more.

In one respect I agree with Senator Cruz. Senate Republican Leaders did “want” the clean debt limit bill to pass the Senate and they wanted the political cover of voting no. Senator Cruz exposed this through his objection, forcing not just Senators McConnell and Cornyn, but a bunch of others as well, to vote aye on cloture so that they could get to a final passage vote where the bill passed but all Republicans voted no.

But they were right to vote aye on cloture. Senator Cruz skips over why the others wanted this outcome: the only other legislative alternative was not increasing the debt limit. At that point no one, including Senator Cruz, had an alternative strategy to pass a debt limit bill that cut spending, or repealed or modified ObamaCare, or made any other good policy change.

If you want to defeat a bad bill you need both a better policy and a viable legislative strategy to achieve it. In some cases that legislative strategy could be blocking enactment of any bill, but that would not have worked here. In this case I believe strongly that not raising the debt limit is far worse than enacting a clean debt limit increase.

This then provokes a series of questions for Senator Cruz.

Q1: “Do you agree that not raising the debt limit is a worse policy outcome than enacting a clean debt limit increase?”

If the answer is yes, then:

Q2: “What was your alternative legislative strategy for enacting a debt limit increase that also contained some other reform?”

If the answer is “I didn’t have one,” then:

Q3: “Weren’t the Senate Republicans who supported cloture therefore doing the right thing, even at some political cost to themselves?”

It’s easy for any one person to design a bill that is (debt limit increase + X), where X is a good fiscal or other policy reform. It’s much harder to get a lot of votes for any particular such bill. House Republican leaders were unable to pass such a bill in the House with any X, good or not-so-good.

And once the House had passed the only debt limit increase it could pass, Senate Republicans were stuck in a take-it-or-leave-it position. Informally we say the House jammed Senate Republicans: Senate Rs were forced to choose between two outcomes, both of which they hated. Had House Republicans been able to pass a debt limit increase with an additional reform attached, then Senate Republicans would have had available another, less worse, option.

Last year I proposed a legislative strategy (including in the Wall Street Journal) to get a small policy concession along with a debt limit increase. The House did a version of this strategy and, as a result, successfully pressured a Democratic Senate into passing a budget resolution. I pushed a variant of this strategy again in September, but this time House Republicans couldn’t execute because they didn’t have the votes.

As was the case in last fall’s CR/shutdown battle, this week Senator Cruz did not have a legislative strategy with an endgame. He neither presented an alternative strategy to his colleagues nor pursued one as a lone wolf on the Senate floor. In both cases he simply made a single aggressive tactical legislative move that didn’t point toward an alternative outcome, then accused his colleagues of being cowardly, unprincipled, and deceptive for not following his lead into a blind canyon.

Some will say, “At least Senator Cruz was willing to fight!” Unfortunately, this argument always stops there, and never explains how a willingness to fight without a strategy translates into a policy win. Legislative conflict is not a schoolyard tussle in which the bigger or tougher guy usually wins. It’s not a Hollywood movie in which the hero triumphs simply because he is virtuous. Legislative conflict is more like chess in that the battle is waged according to strict rules. Those who favor bigger government know how to play chess and some of them are quite good at it. Many of those who favor smaller government now seek praise for tipping over the board or eating the pieces. While momentary rebellion is flashy and can feel good for a moment, it’s not a strategy to win, not how you change policy. And the goal is to change policy for the better, not just to build a bigger mailing list, right?

It’s frustrating because I agree with many of Senator Cruz’ substantive policy goals. I want a smaller government and a larger private sector, less government spending, and less debt. I want to replace ObamaCare with consumer-driven health policies. I am frustrated by the President’s economic policies, by those who twist policy to suit their self interests, and by politicians in both parties who facilitate that behavior.

But having the right policy goal isn’t enough to succeed, to change policy. You also need a legislative strategy with an endgame and some chance of success. As best I can tell Senator Cruz didn’t have one last fall and he didn’t have one earlier this week. His tactical legislative moves, then and now, need to be considered in that context. The same is true for his public comments surrounding those legislative moves. His objection this week served only to expose that Republicans were boxed in, forced to choose between facilitating passage of a bill they didn’t like and an even worse policy outcome. And they were boxed in because they could not build sufficient support for a unified legislative strategy that had a chance of success.

I hope that in the future Senator Cruz can use his intellect, political savvy, and external base of support to produce effective strategies that produce the good policy results we both support, instead of using his prodigious skills and resources only to assign blame for the bad outcomes.

Response to the President on minimum wage

In his weekly address, Calling on Congress to Raise the Minimum Wage, President Obama said:

And this week, I took action to lift more workers’ wages by requiring federal contractors to pay their employees a fair wage of at least $10.10 an hour. … This will be good for contractors, for taxpayers, and for America’s bottom line.

I see how a higher mandated minimum wage benefits low wage workers working at federal contractors. I don’t see how increasing labor costs is good for the contractors that employ those workers or how it’s good for the taxpayers who pay those federal contracts and must now spend more for a given amount of labor.

The President further says:

These are workers who serve our troops’ meals, wash their dishes, care for our veterans …

OK, I agree that employees of some federal contractors do things that I think are good. But raising their wages means that any given amount of tax dollars spent on troops meals and veterans’ care will buy fewer hours of labor delivering those services. While those who serve the food and give the care (and still have their jobs) are better off, those eating the meals and receiving the care are worse off because fewer hours are being spent delivering those services, right? The only way to make both the workers delivering the care and the veterans receiving that care better off, after a wage increase, is for taxpayers to pay more.

In other places the Administration cites research that workers who are paid higher wages have more job satisfaction, do better work, and quit less frequently. The logic is that higher paid workers are happier workers, and happier workers will move the food line faster and deliver better health care to veterans. That seems reasonable, but employers, including federal contractors, have economic incentives to take those benefits into account when they decide how much to pay their employees. As employers try to get the most output for each dollar they spend on labor costs, they are (if they want to be competitive) balancing the morale, productivity, and turnover benefits of paying higher wages with the costs of hiring fewer higher-wage workers for fewer hours. What President Obama did was instead substitute his judgment for where that balance point should be set, and we know he has to be getting it wrong in a lot of cases because that balance will differ from one employer to the next.

The President says:

The opportunity agenda I’ve laid out is built on more new jobs that pay good wages … Right now, there’s a bill in Congress that would boost America’s minimum wage to $10.10 an hour. … If they don’t support raising the federal minimum wage to ten-ten an hour, ask them “why not?”

I oppose any increase in the minimum wage because it lets government decide to sacrifice more jobs for some, to get higher wages for others. I don’t think government should make that call.

The higher the government-mandated minimum wage, the fewer jobs and hours of labor employers will buy. Those on the Left don’t dispute this, they instead respond, “But it’s not a big cut in jobs and hours.” While I think many of the advocates for a higher minimum wage cherry-pick their studies, I also don’t think the government should force any cut in jobs and hours, even a small one. I therefore think the market should determine this trade-off, not politicians running for elected office and courting the support of organized labor.

President Obama is for higher wages for some, with fewer jobs and hours for others, with both determined by politicians. I’m for more jobs and hours, with wages determined by competition in a healthy and growing market economy.

The best ways to help low skill workers are (1) to help them raise their skills over time through education and job training so they are worth more to potential employers; (2) to have government policies that encourage strong short-term and long-term economic growth so that employers want to hire more people and bid wages up in a competitive and flexible labor market; and (3) to reduce government barriers, like high implicit effective tax rates, that make it harder for these workers and their families to reach the middle class. If those policies don’t raise their incomes enough in the short run, then the way to help them is through explicit redistribution policies like the earned income tax credit and food stamps, not by substituting campaigning politicians’ judgment for that of the market.

Ladder vs. Safety net

When designing economic policies there is often a trade-off between our desire to provide immediate financial assistance to those who have our sympathy and our desire to maximize the opportunities for their long run success. If you give financial assistance to someone in need but tell them you will take it away once they no longer need it, you water down the incentive they have to make the effort to improve their own condition. This diminished incentive has an effect on labor supply.

In other words, there’s a trade-off between the ladder and the safety net. The higher we make the safety net the less economic sense it makes for someone in that safety net to grab the bottom rungs of the ladder and begin to climb. Rather than becoming a net that protects us from hitting the hard ground, we get caught in it and cannot escape, not because we don’t want to, but because government policies financially discourage us from doing so.

Politicians, especially on the left, love to express/feign outrage when this point is made, and suggest that (a) it’s not true and (b) the person suggesting it is accusing people of being lazy. But while the magnitude of the incentive effect is often subject to debate, the existence and direction of those effects is most often not. CBO’s latest analysis of the labor supply effects of ObamaCare reinforces this point: if you make work less financially rewarding you’ll usually get less of it.

Poorly designed policies don’t change the motivations of people with modest income, they change the calculations people make about whether they should make short-term economic sacrifices for longer-term economic gain. Why pay $500 for a night course (and give up your evenings) to get a $1,000 annual raise if the government will “grab back” a significant portion of that extra $1,000 by reducing your benefits? You may be driven to advance yourself professionally but make the rational decision that it’s not worth the sacrifice because of the amount of government subsidies you receive and the way they’re designed to phase out as your income climbs. CBO’s labor supply conclusions assume people who cut back on paid work because of their big new health insurance subsidies are rational, not that they are lazy.

Let’s look at three examples.

1. Extended unemployment insurance: The academic evidence is pretty clear that extending unemployment insurance benefits increases the amount of unemployment. In some cases that’s driven by individuals, some of whom ramp up their job search only as their UI checks are running out. In other cases it’s driven by employers who temporarily lay off workers (like an auto manufacturer closing an assembly line) and keep the line closed until right before benefits run out. I’ve seen estimates that the current extended UI benefits add anywhere from 0.1 percentage points (CBO) up to 0.5 percentage points to the unemployment rate.

Does that mean UI benefits should not be extended? No, it simply means that there is a cost to do doing so that should be weighed against the benefits. Policymakers must balance the compassion benefits of helping those who don’t have jobs and are trying to find them, with the costs of providing taxpayer assistance to those who could find jobs but just aren’t looking, and the broader macroeconomic costs of slowing the pace of economic recovery. Reasonable people can disagree on where and how to draw this line based on how they value those conflicting goals. But it’s silly to suggest, as President Obama has done, that there isn’t a trade-off, or that it’s somehow offensive to suggest that extending UI benefits could hurt workers and economic growth. There is a trade-off, an unavoidable one, between helping those now unemployed pay their bills and getting the most people back to work as quickly as possible.

2. Minimum wage: If you’re now making $7.25 an hour and the minimum wage were increased to $9 an hour you would fall into one of three categories. If you still have your job after the minimum wage increase, then you’re better off. If your employer replaced you with a friendly robot that was cheaper than paying you $9/hour, then you’re worse off. If your employer cut back your hours, you may be better or worse off, depending on how much your hours were cut back and what else you can do with that time.

This then provokes a value-neutral analytic question and a values question. We ask the economists, “For any given proposed minimum wage, how many people will fall in each category?” Then we must ask if the benefits to those in category one are worth the costs paid by those in categories two and three.

Reasonable people can disagree on the values question, and depending on where policymakers fall, they tend to pick and choose the economic analyses for the analytic question that support their value choice. But if you listen to President Obama you’d conclude that raising the minimum wage has only benefits and that anyone who opposes a minimum wage increase is driven only by selfishness and malevolence toward low wage workers. That’s absurd. Increasing the minimum wage will reduce constrain the available labor supply and hurt some low-skilled workers. We can debate how much and whether it’s worth it, but there are unquestionably winners and losers.

3. ObamaCare: Providing low and moderate-income individuals and families with subsidies to buy health insurance outside of employment helps the bottom lines of those families. Phasing those subsidies out as income climbs allows taxpayer resources to be targeted based on economic need. But it also changes the incentives people have to work, to go to school, to get additional job training, and to try for a promotion. The bigger the subsidies and the sharper the slope of the phaseout, the bigger the disincentive created for people to try to make more money so they can get off these government subsidies and provide for themselves. This disincentive matters: CBO says ObamaCare will reduce hours worked by 1.5 to 2 percent, and that “the largest declines in labor supply will probably occur among lower-wage workers.” Fewer people will work, and others will work fewer hours. Total wages will decline by about one percent.

I am not arguing for no social safety net or for no unemployment insurance. I am instead arguing what should be obvious and shouldn’t need saying, but does: every time we raise the safety net, we provide immediate beneficial aid to many, and we make it less profitable for them to “climb onto the ladder of opportunity” and push themselves to earn more, and this calculation has an effect on people’s behavior. Ongoing UI checks help pay the bills but also relieve the pressure to find a job immediately. A higher minimum wage increases the wages of those low-skilled workers who still have jobs, but it also reduces the opportunities for an unskilled teenager to learn how to hold down a first job and learn basic professional skills. Subsidized health insurance helps the people who receive it. When those subsidies phase out as income increases, they also reduce both the number of hours worked and the number of people working. The reduced labor supply hurts the economy as a whole and is generally bad for those people receiving subsidies as well, because they are being pushed by government policies to forego economic opportunities that could help them even more in the long run than do the immediate benefits they are getting.

And these government programs and subsidized benefits stack. The cost-benefit calculation of short-term compassionate aid and long-term compassion to create opportunity depends on your starting point. Most everyone would say that some unemployment insurance is good, but it’s not surprising that there is disagreement about the costs and benefits of providing more than three years of UI benefits. Similarly, there are few who would say we shouldn’t subsidize health care for the poor, but when CBO says that a new law will reduce labor supply by 1.5 to 2 percent, that’s a really big cost. And it’s bigger because ObamaCare’s subsidies are layered on top of other programs that also have income phaseouts.

The costs of all three of these policies include higher structural unemployment and fewer people building additional skills to move up the income scale over time. When the U.S. economy eventually recovers fully, our unemployment rate should be in the low 5s. Because they keep layering on “protections” and “assistance,” France’s comparable rate is around 10 percent. Imagine if the U.S. steady-state unemployment rate were 10 percent. We’re not there yet, but all of President Obama’s policies push us toward a European-style model.

I think movement in that direction is a huge mistake, but my point today is a more basic one. These trade-offs must be considered and debated openly, and the Obama Administration is doing a disservice by suggesting that no trade-offs exist, and that those who oppose these programs do so because they are mean. Extending unemployment insurance benefits, raising the minimum wage, and ObamaCare have long-term labor supply costs that must be weighed against their more immediate benefits. There is no free lunch here. Do you want a stronger ladder or a higher safety net?

(photo credit: Jonathan Khoo)

ObamaCare’s trap makes it harder to reach the middle class

I will give you, fresh from the oven, either a home-baked Toll House chocolate chip cookie or a Krispy Kreme donut. Your choice.

Let’s say you choose the donut.

Now I pour rancid ketchup on the donut and offer you the choice again.

You now choose the cookie.

Based on his press briefing yesterday, the President’s CEA Chairman, Dr. Jason Furman, would say I didn’t kill the donut option because taking the cookie was your choice.

The individual health insurance market subsidies in the Affordable Care Act do two things: they subsidize some low wage workers, and they make work less attractive for those workers by increasing the effective marginal tax rate on higher income.

Because the ACA premium subsidies depend on income, the higher your income, the smaller your premium subsidy. This makes sense if a policymaker has limited resources to spend and wants to help those who need it most. The problem is that it also means that as your income climbs you lose some of those government subsidies. It works the same way as a marginal tax rate increase: you get less net financial benefit for additional income. This is an unavoidable downside of a social safety net based on income.

This downside is independent of what the subsidies are used for. This same problem applies to food stamps, the Earned Income Tax Credit, low-income housing vouchers, and in fact any government benefit that gets reduced as one’s income climbs. The effect results from phasing out subsidies as income climbs, any kind of subsidies.

ObamaCare’s defenders are taking two tacks today. First, they are emphasizing the significant financial benefits of those subsidized premiums to the people who receive them. That’s totally fair. They are also trying to argue that, when people choose not to work after the government increases their [effective] marginal tax rate, that’s OK because it’s the person’s choice not to work. That is Orwellian.

Here is CBO:

For example, some provisions will raise effective tax rates on earnings from labor and thus will reduce the amount of labor that some workers choose to supply.

If you choose to work less because you want to spend more time with your kids, that’s a good thing. If you choose to work less because the government raised your marginal effective tax rate and made work less financially rewarding, that’s a bad thing.

Here is an example:

- A family of four with one wage-earner has $35,300 of income this year and no health insurance through work. Because of the significant Affordable Care Act subsidies, this family can buy health insurance for only $1,410/year.

- The other spouse wants to take a part-time job to supplement their family income. This part-time job would earn them an additional $12,000 per year (gross).

- But this additional income would reduce their ACA premium subsidy, so they would now have to pay $2,970/year for the same health plan.

- This reduced subsidy, a direct result of the spouse’s part time work and higher family income, reduces the value of the $12,000 of added income by $1,560 (=$2,970 – $1,410). That subsidy reduction is 13 percent of the gross income increase.

- So maybe this spouse chooses not to take the new part time job because the net financial benefit of additional paid work just isn’t worth it.

My back-of-the-envelope calculation, using H&R Block’s tax calculator, is that the ACA increases this moderate income family’s marginal effective [federal] tax rate by 13 percentage points, from about 37% to about 50%. The 37% includes very little income taxes, but a lot of reduced EITC and reduced refundable child credit, as well as higher employer and employee-side payroll taxes. The ACA subsidy phaseout adds another 13 percentage points, getting this family up to about a 50% marginal effective tax rate. I doubt State taxes change it much for a family with this moderate level of income. I may be understating the base 37% rate because I’m not looking at other in-kind benefits for which this family might be eligible. I’m confident in the 13 percentage point increase number for this income change.

Do the ACA premium subsidies help this family afford health insurance? Absolutely.

Is that a good thing for this family? Yes.

Does the 13 percentage point increase in this family’s effective marginal tax rate harm them? Everyone except the Obama Administration and a few of its doublethink allies would say yes.

Does the spouse take a part-time job? It depends. The higher marginal tax rate could cause her [him] to work more to get a higher net income, or less because the additional work just isn’t worth the additional pay. Economists call the first the income effect and the second the substitution effect. CBO’s analysis says that, on net, the second effect dominates, and the premium subsidy phase-outs as income rises will cause people to work less.

A lot less.

Finally, the hard one: Do the benefits of the premium subsidy to this family outweigh the costs of trapping this family at this income level by killing the financial benefit they receive from more work, education, training, or other professional advancement? I say no, but that’s a value choice where others might differ.

Team Obama and their allies don’t want to debate it, though, and for good reason. They’d lose. Nobody wants to trap people and discourage further economic advancement, even if they do so by helping that family with generous subsidies. Unfortunately you can’t have one without the other, and so Team Obama obfuscates.

For the past month elected officials have been talking about making sure the “bottom rungs of the ladder of opportunity” are strong. If, however, you raise the safety net so high that it is above those bottom rungs, then people would be irrational to start climbing the ladder at the bottom. That’s the unavoidable downside of the generous income-targeted premium subsidies in the Affordable Care Act. Choose your poison: give these people less immediate assistance, or punish them more as they try to improve their own lot. President Obama and ObamaCare’s supporters chose the latter course.

Note also that this subsidy phaseout doesn’t only discourage additional work, it discourages anything that increases one’s income, including additional job training, education, or even a promotion to a better-paying job. The marginal benefit one gets from any of these income-increasing opportunities is smaller because the government “claws some of it back” by reducing the generous ACA premium subsidies as one’s income grows.

Yes, many ObamaCare critics were imprecise yesterday when they said “2 million jobs” would be lost. CBO actually said the ACA would reduce “the number of full-time-equivalent workers” by about 2 million in 2017, rising to about 2.5 million in 2024. Some of that will be people choosing not to work at all (like maybe our example spouse), while the rest will be people choosing to work less. Both are reductions in the labor supply, and both are indisputably bad when they result from government making work less financially rewarding. This is, however, a minor language error, not a core flaw in the argument being made by ObamaCare’s opponents.

Now is it fair to say that ObamaCare “kills jobs?” I think it is. Some on the Left argue that since the reduced employment comes from workers “choosing” not to work rather than employers choosing not to hire them, it’s somehow not a lost job. That’s silly. There will be fewer people employed and fewer hours worked because of this law. Jobs result from the interaction of supply and demand curves for labor. If policy moves the demand curve down or the supply curve left, the number of jobs will decline and jobs will be “killed” by the policy change. And please don’t tell me that it’s OK because these workers are choosing to work less, unless you also think that me pouring rancid ketchup on your donut didn’t make you worse off because you then chose the cookie.

But the new policy vulnerability revealed by CBO does not rely on the phrasing “killed X jobs.” If my semantic argument is too confusing, there are plenty of other simple ways to make the same underlying point and explain the damage this law does to employment, income, and opportunity, especially for those with moderate incomes who are trying to improve their economic situation.

What should opponents of ObamaCare say? Here are a few variants of the same concept.

- ObamaCare contains a big hidden [effective] tax rate increase on moderate income workers and families trying to climb the economic ladder to the middle class.

- ObamaCare encourages moderate income people to work less, and drives some out of the workforce entirely, by effectively raising their taxes. (hat tip: Charles Blahous)

- ObamaCare will shrink our economy by driving millions of moderate income people to work less, and discouraging some of them from working at all.

- ObamaCare pairs generous premium subsidies for moderate income individuals and families with a massive hidden tax rate increase on additional work.

- ObamaCare punishes additional work, especially for those who want to climb into the middle class. A family of four with income in the mid 30,000 range would face about a 50 percent effective tax rate.

- ObamaCare punishes additional work, education, job training, and professional advancement, anything that generates additional income, for those trying to climb into the middle class.

Finally, I think Paul Ryan nailed it today with the word trapped. Yes, these new subsidies benefit the families who receive them. They also trap these workers and families by killing much of the economic benefit one gains from additional hard work. Elected leaders across the policy spectrum have been stressing the importance of making it easier for people to improve their own lot. This law undermines that goal for millions of people.

Has President Obama given up?

For two weeks President Obama and his team have been setting up the argument that since he can’t get Congress to enact his proposed legislative agenda, this year he will use the formal power of executive action and the persuasive power of the bully pulpit to do what he can to solve economic problems. President Obama seems to be writing off major legislative progress on economic policy this year, conceding that he cannot find compromises with a Republican majority House. He will therefore take mostly symbolic actions this year to energize his political base and reinforce his party’s ballot box chances this fall. Whatever your view on a minimum wage increase and the extension of unemployment insurance, they are economic small ball. The only significant economic legislation he seems likely to ask for is trade promotion authority (which I support).

I’m sure President Obama understands just how constrained are his options for executive action. Even with lawyers willing to push the constitutional envelope and a friendlier DC Circuit Court to back them up, the president’s ability to make major economic policy changes without Congress is quite limited, and he has to hope a future Republican president won’t unilaterally undo what he unilaterally does. His pen is more like an erasable pencil, and the “he has a phone” argument is a bit pathetic. Without a legislative agenda and the ability to enact it, a president can affect economic policy only around the edges.

I therefore don’t understand the next step in President Obama’s “phone and a pen” argument. While the Senate majority is in play this November, the House majority is not. It is extremely likely that Republicans will keep the House, and almost as likely that they will continue to struggle to function as a governing majority party in 2015 and 2016. Next year and the year after President Obama will face a legislative challenge as big or bigger than he faces now.

I agree that it’s quite hard to build a legislative strategy in the current legislative and political environment. But does that mean you don’t even try? Working with a Republican House and Senate, President Clinton signed Gramm-Leach-Bliley into law in 1999, the year after Republicans impeached and tried him. Working with a Democratic House and Senate, and when he was fiercely unpopular with Democrats, President Bush enacted an energy law in 2007 and TARP in 2008. All three of these laws were enacted in intensely partisan legislative environments only because of strong presidential leadership.

If President Obama has given up hope of finding principled economic policy compromises with a Republican majority House this year, what is his game plan for his final two years? Next year will he try to figure out a way to cut the legislative Gordian knot, or instead just recharge the phone and buy some more pens and pencils? Has President Obama given up on Congress, and therefore on economic policy, for the next three years?

(photo credit: White House photo by Pete Souza)

Two presidential errors on unemployment insurance

Last week President Obama said:

<

blockquote>But there’s an economic case for

By leaving out one word, President Obama got this exactly wrong. The missing word is temporarily.

The “helps the economy” case for increased government spending on additional unemployment benefits is a traditional fiscal stimulus argument: if the government increases spending, people will have more income. They will then spend some/most of it, generating more income for others, and so on. Depending on the type of spending, economists estimate/guess the fiscal multiplier of a dollar of increased government spending (or tax cuts!), then calculate the increase in GDP that will result. From this they estimate the increased employment that will flow from the government’s fiscal stimulus.

Economists like to argue about the size of multipliers for various types of fiscal stimulus. But as best I can tell, they don’t argue that a temporary fiscal stimulus results in permanent economic growth. Once government stops spending money, the beneficial growth effect, however big or small it may be, dissipates.

Now the hope of a traditional fiscal stimulus is that it jump-starts an economy stuck in a rut, providing a big enough temporary boost that the recovery becomes self-sustaining even after the stimulus is withdrawn. Think of it like a strong cup of coffee early in the morning. If all goes well, the initial jolt gets you going enough that you maintain a high energy level even after the caffeine hit has worn off.

It is quite difficult to make such an argument for such a small proposed policy change. An additional $25 B in government spending, in a $16.6 trillion economy, doesn’t come close. It would be like hoping that one sip of coffee will jump start your day. Qualitatively the argument can hold, but it’s not big enough to be credible (assuming you buy the assumed fiscal multipliers in the first place).

President Obama should have said “extending emergency unemployment insurance temporarily helps the economy.” But he didn’t say that because it’s a much weaker argument. By omitting this key word, he implied that this policy is unambiguously good for the economy as a whole, and not just for the recipients of the added benefits.

President Obama then doubled down on his flawed argument by adding:

That’s why, in the past, both parties have repeatedly put partisanship and ideology aside to offer some security for job-seekers with no strings attached. It’s been done regardless of whether Democrats or Republicans were in the White House. It’s been done regardless of whether Democrats or Republicans controlled Congress. And, by the way, it’s been done multiple times when the unemployment rate was significantly lower than it is today.

In the current legislative context “with no strings attached” mostly means “without cutting other government spending, either now or in the future, so there is no net deficit increase.” President Obama wants to increase government spending by $6 B over the next three months (or $25 B over the next year when it inevitably gets extended) without any budget offsets. Deficits and debt would be higher if he gets his way.

His problem is that this turns his fiscal stimulus into a net economic loser over time. If you buy the Keynesian models, the initial positive bump to GDP from the fiscal stimulus is temporary, but in exchange for that you get a permanent increase in debt because you’re not offsetting the added government spending.

That added debt creates an additional fiscal burden (higher interest payments) and the higher budget deficits create an economic cost as well, as lower national saving leads to a smaller future capital stock, slower productivity growth, and lower future wages.

So, even in a CBO-scored view of the world, in which fiscal stimulus works and fiscal multipliers are big enough to matter, a temporary, not-offset increase in government spending like that proposed by the President, results in:

- a temporary increase in economic growth and jobs;

- a permanent increase in debt and net interest costs;

- and a net decline in economic growth and income over time, as the short-term benefits dissipate and the long-term costs gradually accumulate.

This does not definitively mean you shouldn’t do the policy, by the way. You might conclude that a little added growth and job creation now is worth a bigger economic and fiscal downside in the future. Or you might think the compassionate benefit of helping the unemployed is worth the aggregate downsides of a policy that is a net fiscal and macro negative over a longer timeframe. The President said this yesterday when he said that helping some (unemployed) Americans is more important than economic growth for all Americans. Even if you agree with the President’s value choices, that does not excuse his flawed economic arguments.

If you limit your view to only the next year, then what President Obama said is true: the traditional macro models show increased economic and job growth from his proposed policy change. A more comprehensive, longer view allows you to see both the costs and benefits of the President’s policy, and you have to decide whether slamming a couple of Red Bulls now is worth the caffeine crash later.

Although, given the size of this policy, maybe this is more like taking a couple of sips of Red Bull. While the President got his economic arguments precisely backward because he ignored the out-year costs, this is a debate about a fairly small policy change. Relative to a $16+ trillion economy, this really isn’t big enough to matter much either way.

Still, that doesn’t excuse bad economic arguments.

(Official White House photo by Pete Souza)

Redistribution vs. Growth

Here is President Obama today, speaking before meeting with his Cabinet.

We want to maximize the pace of our recovery, but most importantly, we want to make sure that every American is able to benefit from that recovery, that we’re not leaving anybody behind and everybody is getting a fair shot.

With “but most importantly,” President Obama is prioritizing distribution over growth. He is saying that helping some Americans is more important than economic growth for all Americans.

Kudos to the President for actually making a choice–most politicians would falsely assert that there is no tradeoff between faster economic growth and greater equity. There often is.

Too bad he’s chosen the prioritization that’s opposite of my own: growth, growth, growth, in the short run and the long run.

Here is what I wish the President had said instead.

We want to maximize the pace of recovery. The surest way to help the greatest number of Americans is for government to create conditions that allow for rapid economic growth and job creation. And the best way to make sure every American has the chance to benefit is to create an expanding economy with opportunities for all.

(photo: Official White House Photo by Pete Souza)