The President’s Budget prominently features (on page 146, under Table S-1, the Budget Totals summary table) this language:

FISCAL COMMISSION

The Administration supports the creation of a Fiscal Commission. The Fiscal Commission is charged with identifying policies to improve the fiscal situation in the medium term and to achieve fiscal sustainability over the long run. Specifically, the Commission is charged with balancing the budget excluding interest payments on the debt by 2015. The result is projected to stabilize the debt-to-GDP ratio at an acceptable level once the economy recovers. The magnitude and timing of the policy measures necessary to achieve this goal are subject to considerable uncertainty and will depend on the evolution of the economy. In addition, the Commission will examine policies to meaningfully improve the long-run fiscal outlook, including changes to address the growth of entitlement spending and the gap between the projected revenues and expenditures of the Federal Government.

The President therefore defines the Commission’s short-term job as “balancing the budget excluding interest payments on the debt by 2015.”

This means the President’s goal is to run a budget deficit in 2015 that does not exceed the amount the government will spend on interest in that year. This is not a balanced budget goal. It’s a deficit reduction goal that falls far short of balance. The Administration is using clever language to make it sound like a balanced budget goal.

Now we need to do three things:

- Figure out how much the government will spend on interest in 2015. That is the President’s deficit reduction target for the Commission.

- Compare the target with the deficit that OMB says would result from the President’s policies. Then we know how much more deficit reduction the Commission would need to achieve after enacting the President’s specific proposed policies. We can also compare it to the policies in last year’s budget.

- See what the resulting debt would be, which the Budget says would be “an acceptable level.”

Step 1: How much will the government spend on interest in 2015?

Nothing is easy in budget-world. It turns out there are three different answers to this question. When CBO scores the President’s budget there will be four.

CBO says that interest payments on the debt in 2015 will be $459 Billion. This is CBO’s baseline number, their starting point for analyzing proposed policy changes like the President’s Budget. CBO says that in 2015, $459 B is 2.5% of GDP. (CBO’s Table 1-3)

OMB defines the baseline differently, projecting net interest payments of $586 B in 2015, which OMB thinks is 3.05% of GDP in that year. (OMB’s Table S-3)

The President’s Budget proposes policy changes, of course. OMB thinks those policy changes will trim 2015 deficit payments by $15 B in 2015, to $571 B. That’s 3.0% of GDP. (OMB’s Table S-4)

This allows us to build the following table.

Net Interest Payments

| OMB | CBO | |

| Baseline ($) | $586 B | $459 B |

| Baseline (% of GDP) | 3.05% | 2.5% |

| President’s policies ($) | $571 B | not yet available |

| President’s policies ($) | 3.0% | not yet available |

OMB would of course use the OMB column, and they would assume that the President’s proposed policies would be enacted. So I think they would say the goal of the President’s proposed Fiscal Commission is to reduce the deficit so that by 2015 it does not exceed $571 B, or 3.0% of GDP.

CBO will come up with a different score of the President’s policies in a month or so when they rescore the President’s Budget. For now let’s use $571 B / 3.0% of GDP as the target.

Step 2: How big of a gap would the President’s Commission need to close?

OMB says that the President’s proposed specific policies would result in a 2015 budget deficit of $752 B, or 3.9% of GDP. Subtracting, this means the Commission would need to close a $181 B deficit gap in 2015, or 0.9% of GDP.

For comparison:

- Built into his specific policy proposals to get to a 3.9% deficit in 2015, the President proposes increasing taxes on those with incomes above $200K (single) / $250K (family). Those proposals would reduce the budget deficit by raising taxes $97 B in 2015.

- CBO says the new subsidies in the Senate-passed health bill would increase the deficit $74 B in 2015.

The interesting part is that the specific policies in his last year’s budget would have met the goal President Obama now proposes to establish for the Fiscal Commission. One year ago the President said his policies would result in a 2.9% deficit ($528 B) in 2015 (Table S-1), which would meet the President’s new target. In other words, the goal of the new Fiscal Commission is to propose additional deficit-reducing policy changes to close the additional deficit gap opened between last year’s Obama budget and this year’s Obama budget. Some of this gap is the result of a weaker economy, and the rest is because the President is proposing more spending than he proposed last year.

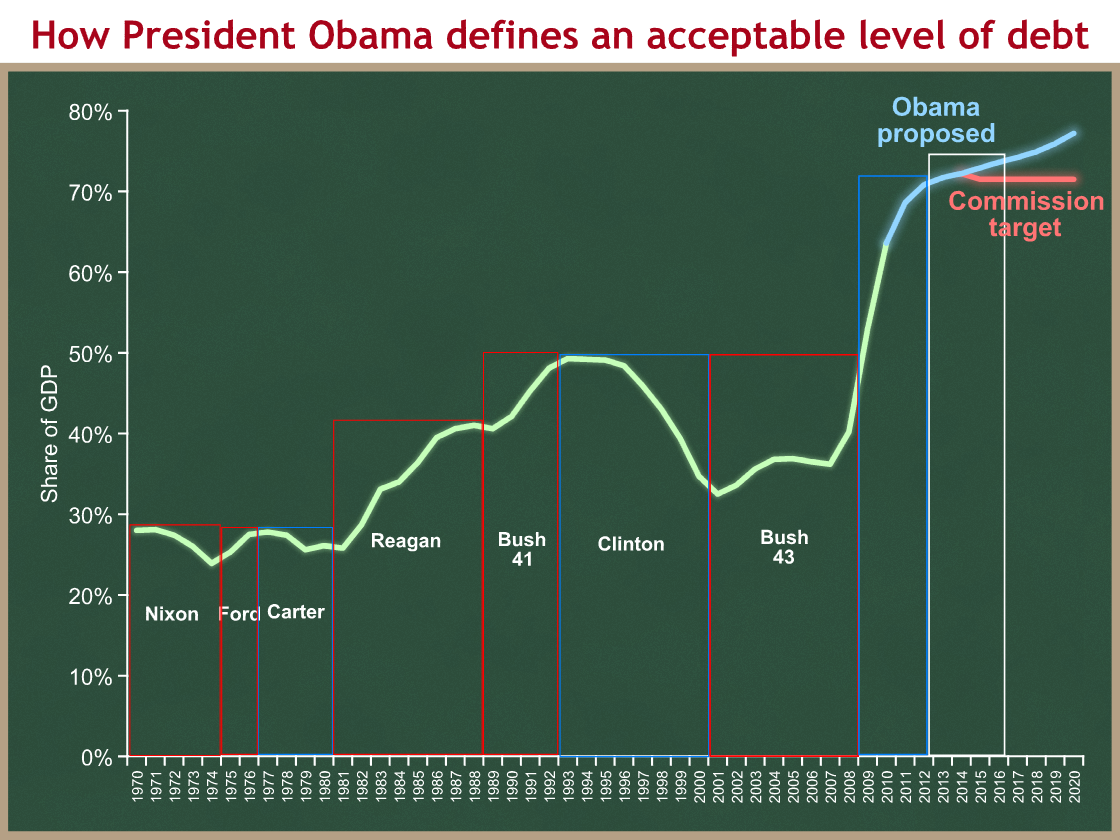

Step 3: Calculate what the President defines to be an “acceptable level” of debt

We now know that the President’s Budget says that if the budget deficit is reduced to 3.0% by 2015 this will be “projected to stabilize the debt-to-GDP ratio at an acceptable level once the economy recovers.” I agree that this deficit level would stabilize debt-to-GDP. Is it “an acceptable level?”

The President’s Budget tells us that his specific policies would result in a debt-to-GDP ratio of 72.9% in 2015, with a 3.9% deficit in that year, 0.9 percentage points short of the Commission’s target. I presume that a Commission would phase their changes in over the next five years, resulting in smaller deficits than those proposed by the President between now and 2015. Eyeballing Table S-1, the President is defining 71-72% of GDP as an acceptable level of debt. I’ll be pick the midpoint and assume a successful Commission stabilizes debt-to-GDP at 71.5%. The Budget creates a little fudge room this with “The magnitude and timing of the policy measures necessary to achieve this goal are subject to considerable uncertainty and will depend on the evolution of the economy.”

Debt-to-GDP last exceeded 70% in 1950 as we were paying off the debt from World War II. We are in 2010 already at about 64%.

Conclusions

- While the President and his team are using the phrase “balanced budget” in their short-term goal for the Fiscal Commission, the actual goal is to reduce the budget deficit to no more than 3.0% by 2015.

- That is a very weak fiscal policy goal, resulting only in stabilizing debt as a percentage of the economy.

- For comparison, President Bush’s budget deficits over eight years averaged 2.0% of GDP, or 2.7% if you assign the TARP to his tenure.

- The specific policies proposed by the President fall 0.9 percentage points short of the Commission’s goal in 2015, or $181 B in that year. This is the gap the Fiscal Commission would need to close.

- This gap has opened since President Obama’s budget from one year ago, which would have met the new target by proposing a 2.9% deficit in 2015. A weaker economy and new proposed spending increases have opened an additional gap that the President proposes to assign to a Commission to close.

- Debt held by the public now equals about 64% of the economy. The President’s specific proposed policies would, according to OMB scoring, allow that to increase to 77% by the end of the decade. The President says the Commission should propose policies to stabilize debt at about 71-72% of the economy and defines this level as “acceptable.” Debt-to-GDP last exceeded 70% in 1950 as we were paying off the debt from World War II.

- The President does not commit himself to proposing the policies recommended by the Commission. The Commission is charged only with “identifying policies to improve the fiscal situation.” The President is still retaining the right to ignore those recommendations, come up with different ones, or redefine his goal after the Commission has reported.

- The long-term goals of the Commission are imprecisely defined: “to achieve fiscal sustainability over the long run … to meaningfully improve the long-run fiscal outlook.” The long run is an even bigger challenge than deficit reduction over the next five years.