In the Rose Garden last Friday, the President proposed policy changes to address problems in the subprime mortgage market. Here are his remarks and a fact sheet. I’m going to do this in three parts: (1) give a few definitions for those who are new to the housing finance world; (2) define the problem; and (3) explain the President’s new proposals.

Let’s begin with a few definitions:

- A subprime mortgage is one in which there is more risk to the lender than from a prime borrower. A subprime mortgage may be to a borrower with poor credit, or for a loan with little or no down payment, no mortgage insurance, or little or no documentation of income. Note that subprime does not necessarily mean low income. Subprime mortgages are just as high a percentage of big loans (jumbos, in which the loan amount is >$417K) as of smaller loans.

- An ARM is an adjustable rate mortgage. This is in contrast to a fixed rate mortgage. In an ARM, the interest rate changes over time.

- A 2/28 mortgage is a specific type of subprime ARM. Typically, you pay a low fixed teaser interest rate for two years (and often no principal). In month 25, your interest rate resets to a (much) higher rate. Your monthly mortgage payments jump, in some cases quite dramatically. And your interest rate continues to reset every six months after the first reset. A 2/28 mortgage (or its cousin, a 3/27) is one in which the interest rate starts low, then jumps after two years. In most cases, you put little or no money down, and you’re hoping that the value of the home will appreciate significantly during those first two years. If it does, you can probably refinance with an affordable fixed rate, since you now have equity in the home. But if the house does not appreciate in value (or if it depreciates), you’re stuck with much higher monthly payments. Problem: In some cases, people bought such a mortgage where they realistically would never be able to afford the higher monthly payments after the reset. In some markets housing prices have declined over the past two years. These people are having trouble making their higher (post-teaser) monthly mortgage payments. So, for instance, imagine a $200,000 30-year subprime ARM, which has a 7% teaser rate for 2 years, followed by a steadily climbing rate beginning in year 3. If market interest rates rise, your monthly mortgage payments could increase from $1,531 in years one and two, to $1,939 in year three, to $2,370 by year five.

- Refinancing is when you get a new loan (presumably, with a better payment stream) that replaces the original loan. Modification is when your lender helps you out by reducing the interest rate, or forgiving a portion of the loan, or allowing you to skip payments for a while, or allowing you to defer payments to the back end of the loan. Foreclosure is when the lender gives up on the mortgage and takes your house.

Now here’s your crash course in the subprime problem. In 2005, 2006, and the first half of 2007:

- interest rates were low,

- home prices were appreciating,

- the economy was strong, and

- financial innovation had increased the ability of lenders to raise capital from markets, and to provide credit to borrowers.

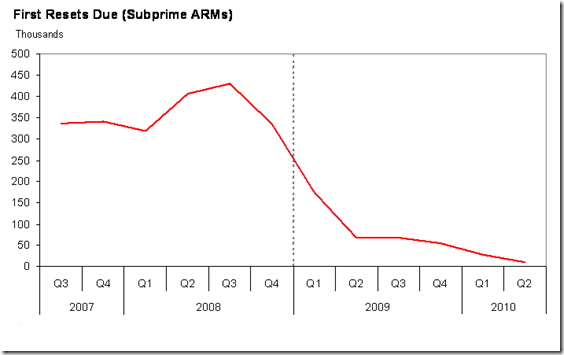

There was also a proliferation of adjustable rate mortgages, especially subprime ARMs. Much of what is happening now is driven simply by the calendar. Earlier this year, the first big chunk of subprime ARMs issued in early 2005 hit their two-year interest rate reset. Those homeowners suddenly saw their monthly mortgage payments jump. At the same time, interest rates were rising, and housing prices were depreciating in some areas (especially California, Arizona, and Florida). Nationwide, the economy outside of the housing and financial sectors is strong, but in some areas of the country (such as Michigan and Ohio) the regional economies are still slow. These factors combined to increase the number of mortgage holders who were facing financial pressure. In the extreme case, there was an increase in the number of foreclosures. You can see from this graph that resets will continue through the first quarter of 2009. Again, this is driven by the calendar. It means this problem will be with us for a while, as more homeowners will face financial pressures as the mortgages issued in 2006 and the first half of 2007 reset. Remember that when you’re still hearing about housing all next year.  Not everyone who faces an interest rate reset loses their home. In fact, we expect more than half of them to either refinance, or just tolerate (and pay) the higher monthly payments. On TV you can now see ads for lending firms that are offering to help you refinance before your reset hits. Some will be on the margin — they can’t quite afford their mortgage, but with a little flexibility from their lender, or a little help from the government, they can stay current. The President’s new proposals fall into this category. Others bought homes they just couldn’t afford. Some of these people knew their payments would increase, and planned for it (imagine a married grad student planning to graduate before his rate resets). Others were betting that future increases in the value of the home would give them enough equity to refinance when their reset hit. Still others didn’t know, or were bamboozled by whoever sold them the loan. For whatever reason, some of these people still have no equity in the home, and they simply can’t afford the higher monthly payments. These are the subprime borrowers most likely to face foreclosure. Subprime mortgages, and the financial securities derived from them, are also a principal causal factor in recent problems in the financial markets. Last Friday, the President announced three new initiatives aimed at helping homeowners who are struggling to meet their mortgage payments:

Not everyone who faces an interest rate reset loses their home. In fact, we expect more than half of them to either refinance, or just tolerate (and pay) the higher monthly payments. On TV you can now see ads for lending firms that are offering to help you refinance before your reset hits. Some will be on the margin — they can’t quite afford their mortgage, but with a little flexibility from their lender, or a little help from the government, they can stay current. The President’s new proposals fall into this category. Others bought homes they just couldn’t afford. Some of these people knew their payments would increase, and planned for it (imagine a married grad student planning to graduate before his rate resets). Others were betting that future increases in the value of the home would give them enough equity to refinance when their reset hit. Still others didn’t know, or were bamboozled by whoever sold them the loan. For whatever reason, some of these people still have no equity in the home, and they simply can’t afford the higher monthly payments. These are the subprime borrowers most likely to face foreclosure. Subprime mortgages, and the financial securities derived from them, are also a principal causal factor in recent problems in the financial markets. Last Friday, the President announced three new initiatives aimed at helping homeowners who are struggling to meet their mortgage payments:

- We’re expanding the availability of mortgage insurance sold by the Federal Housing Administration (FHA). You have to meet certain credit requirements to buy mortgage insurance from FHA. One of those requirements is that you have to be current on your mortgage payments. (Current means you’re not behind.) Our new initiative would allow you to buy FHA insurance even if you’re not current, as long as the reason you were late was because of an interest rate reset (I’ll explain this more in a bit.) You also still need to meet FHA’s other credit tests. This mortgage refinancing product is designed to help homeowners who recently saw their monthly payments jump, and are now having trouble making those payments. We don’t need to change the law to do this — FHA is doing it administratively. We call this FHASecure. The President also renewed his call on Congress to pass our FHA modernization proposal. The President proposed this over a year ago. The House passed a close version of it with more than 400 votes last year. So far, neither the House nor the Senate has acted this year. The proposal would allow FHA to offer lower down payment requirements, to insure bigger loans, and to allow FHA to price premiums based on risk. These reforms would help more first-time homebuyers and those with low and moderate incomes, and would give those refinancing their homes more mortgage insurance options.

- The President proposed changing the tax code. We would make cancellation of mortgage debt a non-taxable event.

Example: You bought a $200,000 house two years ago with no down payment. Housing prices in your area have declined dramatically, so your house is now worth only $180,000. Your monthly mortgage payments just jumped, and you and your lender agree that you won’t be able to make your mortgage payments going forward. Since a lender typically loses 20% (rule of thumb) when they foreclose, your lender wants to modify your loan to work something out with you, so you can keep your house, and your lender will lose less than 20% of the loan. Let’s say your lender decides to forgive (“cancel”) $20,000 of your $200,000 mortgage, so now your $180,000 home is paired with a $180,000 mortgage (I’m oversimplifying.) Under current law, the $20K of debt your lender “canceled” counts as taxable income. If you’re in the 25% income tax bracket, you have to pay $5,000 of taxes on that. Since you”re only in this position because you”re strapped for cash, the one thing you can’t afford is to pay $5,000 more taxes. This makes it less likely that you and your lender will be able to work out the loan modification in the first place, and makes it more likely that you’ll face foreclosure. Conceptually, the tax code now recognizes the decline in your debt, but ignores the decline in the value of the corresponding asset. The President is joining Senator Stabenow (D-MI) and Senator Voinovich (R-OH) in proposing to exempt this cancellation of mortgage debt from taxation. We would have this be a temporary change, and apply only to your primary residence. In the House, Rep. Rob Andrews (D-NJ) and Ron Lewis (R-KY) have proposed a similar change. - Treasury and HUD are reaching out to interested parties in the home financing world — lenders, loan servicers, FHA, the Government-Sponsored Enterprises (Fannie Mae and Freddie Mac), and especially community organizations like NeighborWorks that help struggling homeowners in these situations. They’re looking for synergies to expand mortgage financing options, to educate homeowners about those options, and to match homeowners with lenders.

In addition to the above proposals, last Friday the President discussed policy changes that will reduce the chance that these problems recur in the future. I will describe those soon.