I posted yesterday about Budget Director Peter Orszag’s claim of inherited deficits from his Tuesday speech at NYU, titled “Rescue, Recovery, and Reining in the Deficit.” Today I want to look at the rest of Director Orszag’s remarks.

Let’s dive in.

ORSZAG: This is the responsibility that each subsequent generation of Americans must live up to … to build upon the legacy we have inherited and create an economy that is strong, vibrant, and able to sustain our nation long into the future.

Yet here is what CBO said about the President’s budget in March:

CBO: As estimated by CBO and the Joint Committee on Taxation, the President’s proposals would add $4.8 trillion to the baseline deficits over the 2010-2019 period. … The cumulative deficit from 2010 to 2019 under the President’s proposals would total $9.3 trillion, compared with a cumulative deficit of $4.4 trillion projected under the current-law assumptions embodied in CBO’s baseline. Debt held by the public would rise, from 41 percent of GDP in 2008 to 57 percent in 2009 and then to 82 percent of GDP by 2019 (compared with 56 percent of GDP in that year under baseline assumptions).

A debt-to-GDP ratio of 82% is not “able to sustain our nation long into the future,” especially when it comes in the midst of the demographic bulge driving increasing entitlement expenditures.

ORSZAG: Almost a year ago, in the fourth quarter of 2008, real GDP was declining at a rate of more than 6 percent per year. In that quarter alone, household net worth fell by almost $5 trillion, dropping at a rate of 30 percent a year.

In terms of employment, the fourth quarter saw a loss of 1.7 million jobs … the largest quarterly decline since the end of World War II and a number only to be exceeded by the next quarter when 2.1 million jobs were lost.

This slowdown in economic activity created a pair of trillion-dollar deficits. One was the budget deficit, which had ballooned to $1.3 trillion for last year even before President Obama first walked into the Oval Office. The other was the deficit between what the economy could produce and what it was producing. This so-called output gap amounted to about 7 percent of the economy.

I have no quarrel with this. In fact, I like it, because it correctly focuses on Q4 of 2008. Those who refer to the “recession which began in Q4 2007” are failing to distinguish between the gently declining economy of Q4 07 – Q3 08 and the plummet in Q4 2008 – Q1 2009 induced by the financial shocks.

ORSZAG: To a degree that we had not experienced in more than half a century, we needed to bring the economy back from the brink.

The first step was to restore confidence in the financial system.

We initiated several programs to stabilize the nation’s financial institutions.

I am happy to report that the sense of crisis in our financial markets seems to have passed, and we now are therefore reshaping our efforts to target assistance to the twin challenges of helping responsible families keep their homes and giving small businesses get easier access to credit.

I am assuming by “we” he means “the Obama Administration.” This is one component of the Big Lie – the claim that the financial sector was in collapse on January 20, 2009, and the actions of the Obama Administration prevented that collapse.

Reality: The programs that stabilized our nation’s financial institutions and prevented a systemic financial collapse were:

- TARP;

- Treasury’s temporary guarantee of Money Market Mutual Funds;

- the expanded FDIC guarantees;

- the Federal Reserve’s new liquidity facilities;

- international coordination before, during, and after the November G-20 Summit hosted by President Bush in Washington; and

- firm-specific agreements (“bailouts”) for Bear Stearns, Fannie Mae, Freddie Mac, AIG, Citigroup, GM, Chrysler, GMAC, and Chrysler Financial. (Have I left any out?)

All were designed and implemented before January 20th, 2009, during the Bush Administration, with one exception: some of the Fed liquidity facilities were designed and implementation began during December and January, but they were not turned the first few weeks of President Obama’s term.

The above actions were what “pulled the financial system back from the brink of collapse.” The financial rescue occurred on President Bush’s watch. The financial rebuilding and economic recovery are occurring on President Obama’s watch.

In President Obama’s defense, he publicly supported TARP in September 2008 as a Senator. But for his Administration to claim the financial system was on the brink of collapse when he took office is inaccurate, as is saying they “initiated” programs to “stabilize the nation’s financial institutions.” By January 20th, the patient had been moved from the operating room into an intensive care recovery room. The institutions had been stabilized but were still very weak.

The Obama Administration deserves credit (along with the Federal Reserve) for the stress tests and for continued implementation of the liquidity facilities. These were, however, recovery and rebuilding measures, not collapse prevention measures. (Some argue the stress tests were bad and exacerbated moral hazard. I think they were a net positive but am open to the debate.)

Dr. Orszag has his timing wrong. I used to think this was accidental. I have been forced to conclude that it is part of a broader storyline from Obama Administration officials that intentionally mischaracterizes recent history to assign political blame and credit.

Team Obama’s storyline is “Bush screwed it up; we came in and fixed it.” On the financial sector the actual history is one of remarkable continuity, as politically inconvenient as this may be for the current Administration. This should not be surprising when you look at the personnel involved:

- During 2008 and the first three weeks of 2009, the core team developing and implementing rescue policies was Treasury Secretary Hank Paulson, Fed Chairman Ben Bernanke, and NY Fed President Tim Geithner. I was NEC Director at the time and played a supporting role.

- Beginning January 20th, the core team developing financial recovery and rebuilding policy has been Treasury Secretary Tim Geithner, Fed Chairman Ben Bernanke, and NEC Director Larry Summers. I distinguish between financial rebuilding and economic rebuilding. The latter includes stimulus and Director Orszag as a key player.

- So 2/3 of the core financial policy team is unchanged from last year, although one player has switched chairs.

The other major financial sector initiative from the Obama Administration was the PPIP, or Public-Private Investment Partnership, which Secretary Geithner announced with much fanfare in March, long before it was ready. Remember when PPIP was the Obama Administration’s answer to how to do TARP better than those Bush Administration foul-ups? PPIP has now faded almost to nothingness. Aside from the stress tests, the core TARP capital purchase program now in place is essentially a continuation of that designed and implemented in the Bush Administration. The same is true for most of the other financial sector rescue and recovery policies.

It conflicts with Team Obama’s preferred storyline, but the actual policy story of financial sector rescue, recovery, and rebuilding is one of remarkable continuity across two Administrations.

ORSZAG: Beyond boosting confidence and stabilizing financial markets, the second step was to bolster macroeconomic demand – jumpstarting economic activity and breaking a potentially vicious recessionary cycle.

In light of the massive GDP gap that we faced, the Administration worked with Congress to enact the Recovery Act just 28 days after taking office. That’s much more rapid and bold action than “the inside lag” economists typically attribute to government policymakers.

I have no problem with the logic, and they deserve credit for reducing inside lag to a minimum. Note that the 2009 stimulus law was partisan, while in 2008 the Bush Administration enacted a bipartisan (and smaller) stimulus bill in a month. Compare the bitter partisan debate over the 2009 stimulus with the 2008 stimulus, negotiated by Secretary Paulson, Speaker Pelosi, and Leader Boehner.

The debate will continue to rage over whether the 2009 stimulus was effective and efficient. My primary complaint is with the inefficiency and poor timing, while others (e.g., JD Foster) question the efficacy as well. The “outside lag” on the 2009 stimulus is terrible.

ORSZAG: Over the past eight months, the Recovery Act has made a difference. Estimates suggest that the bill added three to four percentage points to economic activity in the third quarter.

Last week, we learned that the third quarter real GDP growth was 3.5 percent. In other words, effectively all the growth in real GDP during the third quarter could be attributable – either directly or indirectly – to the Recovery Act.

This is another line the Administration pitches repeatedly – that all good economic news should be attributed to a single policy, the stimulus. This is impossible to prove (or disprove) conclusively.

I think Director Orszag’s qualitative logic is correct here, but believe the Administration severely overstates their case. I think instead:

- The severe decline in the real economy in Q4 2008 and Q1 2009 was almost entirely the result of fallout from the financial crisis.

- The Bush Administration + Bernanke + NYFRB President Geithner prevented systemic financial failure and the collapse of the largest financial institutions.

- Once the financial crisis was averted, the primary economic threat was gone. The poisonous stinger had been removed, and now a long and painful but natural healing process had to take place that will eventually lead to economic recovery, GDP growth, and job and wage growth.

- The Bernanke/Geithner/Summers team largely continued the Paulson/Bernanke/Geithner financial policies which prevented collapse. The new team correctly focused on recovery and rebuilding.

- The new team did a good job (I think) with the stress tests, which resulted in banks raising private capital.

- The liquidity facilities (designed during Bush) provided support to damaged securitization markets and large institutions dependent on dried up short-term liquidity.

- Removed threat of financial collapse + financial rebuilding + near-zero Fed Funds rates -> natural healing eventually.

- The stimulus helped beginning in late Q2 or early Q3 2009. Cash-for-clunkers produced a one-time surge in auto demand (which probably sucked demand forward in time and may have weakened Q4 and Q1 auto demand.)

- The +3.5% Q3 GDP number is unquestionably good news. We hope it will continue but are unsure that it will given weak labor markets that are still getting weaker.

- While the stimulus and cash-for-clunkers undoubtedly contributed to Q3’s GDP number, and will contribute in future quarters, it is a dramatic overstatement to attribute all good economic news to the one element of policy that is most hotly debated.

ORSZAG: Unfortunately, even as the economy begins to turn around, the employment picture isn’t going to brighten immediately … as the contrast between the recently reported GDP numbers and the unemployment numbers that we are expecting later this week will likely illustrate.

The sad fact is that unemployment lags a general recovery, and as the President has said, the coming months will continue to be difficult ones for American workers.

The typical progression in a recovery is first an increase in productivity; then an increase in hours worked; and finally, the hiring of additional workers by firms.

I have no argument with the above. It again provokes the above question – when that job growth does occur, I assume the Administration will claim that one policy is responsible for all of it.

It’s important to remember that Presidents get both more credit and more blame for the health of the economy than they deserve. Tomorrow’s monthly employment report will be significant economically and politically. At the same time, it’s quite difficult to affect the tidal forces of the business cycle with fiscal policy, and I don’t “blame” the slow job growth on the Administration. They’re doing the best they can, and I didn’t like the stimulus, but I think their primary macroeconomic failure has been one of poor communications and expectations management. They overpromised on stimulus, and they have tried to take basically bad economic news and frame it as good news. Those are not policy mistakes, they are communications mistakes.

ORSZAG: Although the month-to-month change in aggregate hours worked has not yet turned consistently positive, its decline has moderated from the depths of last fall and winter.

In other words, the employment picture is still getting worse each month. I won’t repeat this point, which I have made ad nauseam.

It also demonstrates how sloppy the Administration’s rhetoric has been this year (but not here). See this LA Times article for many examples of conflicting promises and language. Whatever your views of the Bush Administration’s policies, we were never this sloppy with language. I know – I spent thousands of hours fact-checking and proofreading speeches and documents to be released. Then again, we were held to a higher standard by the press.

ORSZAG: The results were not a surprise, but they were still sobering: the deficit for last fiscal year was $1.4 trillion, or 10 percent of our economy.

Next year’s deficit is expected to be about the same size, and current projections show $9 trillion in deficits over the next 10 years, averaging about 5 percent of GDP.

Deficits of this size are serious – and ultimately unsustainable.

I strongly agree. Most economists I know would say anything sustained above 3% of GDP is unsustainable. When pressed, most would say they dislike but can live with deficits in the 1-2% of GDP range indefinitely, because GDP growth prevents the debt/GDP ratio from increasing. Somewhere between 2 and 3% of GDP seems to be the breakpoint – I use 2.5% as a rule of thumb for the maximum that, while highly undesirable, can be sustained without serious long-term economic damage. I think of this number as a rough ceiling, above which danger lurks.

Since I covered it yesterday, I will skip Director Orszag’s argument about inherited deficits, other than to note that while his speech is titled “… and Reining in Deficits,” he does not actually explain how the Administration would rein in deficits.

ORSZAG: Over the long-term, deficits tend to have some combination of two effects. First, they can raise interest rates and decrease investment, as the federal government goes into the credit markets and competes with private investors for limited capital.

Second, deficits can increase the amount that the United States borrows from abroad, as foreigners step in to finance our consumption.

Either way … whether deficits increase interest rates or borrowing from abroad … the long-term effect is the same: It generates a greater burden on you … our future workers.

If interest rates rise and investment falls, that will make you less productive and reduce your incomes. And, if we borrow more from abroad as a result of our deficits, that means that more of your future incomes will be mortgaged to pay back foreign creditors.

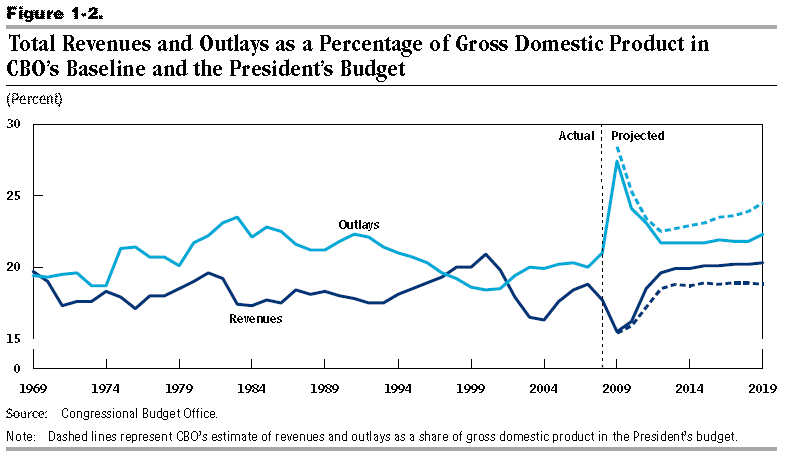

I agree. Why then would you produce a budget that CBO says looks like this, in which you make the, deficit, the gap between projected spending and projected revenues bigger?

Note also that CBO says the President’s budget shifts a flat revenue line down, while it bends the spending curve upward. It’s the increase in the slope of the dotted light blue spending line that is scary. The President’s budget would keep revenues near their post-WWII average of just above 18% of GDP. It’s spending that explodes.

ORSZAG: While we are addressing our short-term economic crisis with deficit spending, as we must, we also are taking on the biggest threat to our long-term fiscal future: rising health care costs.

Our fiscal future is so dominated by health care that if we can slow the rate of cost growth by just 15 basis points per year (that is, 0.15 percentage points per year), the savings on Medicare and Medicaid would equal the impact from eliminating Social Security’s entire 75-year shortfall.

This is another red herring. The reality is:

- Our long-term deficit problem is driven entirely by the growth of spending.

- More specifically, it is driven by the growth of three programs: Social Security, Medicare, and Medicaid.

- The spending growth in these programs is driven by three factors:

- demographics – we’re living longer, and the Baby Boomers are now retiring;

- the Social Security benefit formula grows more generous as our economy grows; and

- Medicare and Medicaid spending grow as per capita health spending grows.

- Director Orszag talks about (3) to the exclusion of (1) and (2), and he focuses on the wrong timeframe.

- Director Orszag’s own graph shows that demographics is a bigger problem than health care costs for the next 30-40 years.

- He’s right that health care cost growth is more significant after that, but we’ll never make it that far on our current path. As Butch Cassidy said to the Sundance Kid who was afraid of jumping from the cliff into the river because he couldn’t swim, “Are you crazy? The fall will probably kill you.” (h/t Andrew Biggs)

ORSZAG: Right now, we are further along toward our goal of fiscally responsible health reform than ever before. I believe that in the weeks to come, the President will sign a bill that gives those with health insurance stability and expands coverage, and does so while boosting quality and reducing long-term deficits.

Let me be clear: any bill that the President will sign will not add to the deficit over the next decade and will reduce deficits thereafter.

Not good enough. “Reducing deficits thereafter” is inadequate. We need fundamental structural reductions in future federal health spending growth to prevent our budget (and the US economy) from collapsing. Trivial amounts of deficit reduction are insufficient to address our long-term federal health spending problem.

The pending health care legislation makes our health spending problem worse than under current law, increases health entitlement spending, and trivially reduces future deficits only by increasing taxes even more than the net spending increases. We should take the Medicare savings proposed in the pending legislation, reconfigure it to save more from fee-for-service Medicare and less from Medicare Advantage plans, and capture those budgetary savings to begin to address our long-term entitlement spending problem. You don’t solve a spending problem by creating a $1+ trillion new spending program.

ORSZAG: This will be done through a “belt and suspenders” approach. That is, we are relying on hard, accountable savings – as scored by the independent Congressional Budget Office – to pay for health reform and we are not banking for that purpose on the potentially much more important cost-savings that will come from transforming the health care delivery system.

In this way, the worst-case scenario is that we have reformed health care and paid for it. But because we’re also taking substantial steps to make health care more efficient over the long term, reform will also undoubtedly help to improve our long-term fiscal standing … even if it is challenging to quantify by precisely how much.

Translation: CBO says these bills would trivially reduce the deficit, leaving our long-term fiscal problems essentially unchanged. He says “we are not banking for that purpose on potentially much more important cost-savings,” but the reality is that Director Orszag cannot convince CBO, his own staff, or the Administration’s official actuaries that his so-called game changing transformations would “undoubtedly” slow the growth of federal spending. If any official estimator agreed with this claim, Director Orszag would have publicized those results long ago.

Director Orszag (and the President) argue that providing people with better information alone will change behavior and reduce utilization of medical care. But information is insufficient … people also need financial incentives to change their behavior, and those incentives are absent from the proposed legislation. Director Orszag tried to steer CBO in this direction when he ran it. As soon as he left, CBO’s career staff steered CBO back to the consensus view.

ORSZAG: Once health reform is passed, however: the job of getting our nation back on a fiscally sustainable course will not be complete. Our current projections of 4 to 5 percent of GDP in budget deficits in the out-years are well above the fiscally sustainable level of roughly 3 percent.

To bring deficits down to a sustainable range, therefore, will require more action once the economy is into a recovery. We are currently considering a number of proposals to put our country back on firm fiscal footing, and to cut the deficit we inherited in half by the end of the President’s first term.

Watch out. I would wager that “more action” and “a number of proposals” are code either for tax increases or a bipartisan commission to provide cover for tax increases. The size of the problem is so large that I don’t see how they can actually solve it without massive reductions in spending growth or middle-class tax increases. The numbers don’t work if you just tax “the rich.”

These statements are also an implicit acknowledgement that the President’s Budget, proposed earlier this year, is insufficient to address our long-term fiscal problems. Why are they waiting until after the new $1+ trillion entitlement is enacted to argue we need to tighten our belts? Deficit reduction would be easier if they began by not spending $1+ trillion more. Then they could use the offsets from the pending health bills for deficit reduction instead.

Also note “cut the deficit we inherited in half by the end of the President’s term.” OMB’s Mid-Session Review shows a 2009 deficit of $1.58 T (11.2% of GDP), and the President proposes to reduce that in FY 2013 to $775 B (4.6% of GDP).

And yet:

- 4.6% of GDP is clearly unsustainable; and

- CBO says the President’s budget would instead increase the FY 2013 deficit by $373 B;

- it’s absurd to measure “cut in half” compared to the year in which there was a one-time deficit spike from the $700B TARP.

ORSZAG: And, after years of failing to abide by the simple principle that you should pay for what you spend, the Administration has proposed statutory “pay-as-you-go,” or, as it’s often called, “PAYGO” legislation. PAYGO would require that any new tax cut or entitlement program be fully paid for – just as we are doing today with health reform.

In the 1990s, PAYGO’s commonsense approach encouraged the tough choices that helped transform large deficits into surpluses … and its absence over the past eight years accounts for the $5 trillion figure that I mentioned earlier.

The Administration claims to abide by PAYGO, but exempts $200+ B to increase Medicare spending on doctors, the $787 B stimulus, and the new $100B – $200B we’re-not-calling-it-a-second-stimulus bill being prepared on the Hill right now. I covered this yesterday in more detail.

ORSZAG: After all, it took us years to dig ourselves into the current fiscal hole. And, it will take years for us to get out.

But I … along with the President and the rest of the Administration … all are committed to making our way … responsibly and rapidly … out of this fiscal hole.

I conclude with the apocryphal First Rule of Holes: When you’re in one, stop digging.