Imagine that Sony plans to bring to market a new TV that is twice as good as the old $500 TV but costs $200 more to produce. If instead it is twice as good but costs $2,000 more, they will probably hold off and look for a less expensive way to improve quality.

Now imagine that TV insurance covers 90% of the incremental cost, so the consumer only sees a price increment of $200 for a TV that costs $2,000 more to make. You, and many others, would demand this new TV, which is high quality but probably low value for you, since the true incremental cost is probably more than you’re willing to pay for that quality increase.

Knowing this, Sony will likely make lots of new high-tech TVs, and will expand their R&D programs to push the limits of TV quality improvement. They won’t care much about the higher costs, because demand for any new quality-improving technology is increased by the presence of TV insurance.

This is likely to be true even if you were also told that your TV insurance premium comes out of your wages, because the cost of that insurance depends mostly on how many of your work colleagues buy new and better TVs. In addition, that insurance premium is both hidden to you and distant when you’re at the store buying the TV.

Americans would have the best TVs in the world, and companies would compete based on who can produce the highest quality TVs, almost regardless of cost.

We don’t have TV insurance today, and yet TV quality improves fairly rapidly. The market, as an aggregated collection of individual purchasing preferences, determines a balance of improved quality and high cost that results in “high value technology improvements.” Sony and its competitors try to meet the demand for high value technology improvements, rather than for any technology improvements without regard to cost.

The hidden nature of employer-provided health insurance and the tax subsidy for that insurance distort people’s decisions so that they purchase health insurance with low deductibles and high premiums. This encourages us to use lots of health care without too much regard for the cost of that care.

In her testimony before the Senate Finance Committee, Kate Baicker explained why insurance causes greater consumption of health care:

Insurance, particularly insurance with low cost-sharing, means that patients do not bear the full cost of the health resources they use. … The RAND Health Insurance Experiment (HIE), one of the largest and most famous experiments in social science, measured people’s responsiveness to the price of health care. Contrary to the view of many non-economists that consuming health care is unpleasant and thus not likely to be responsive to prices, the HIE found otherwise: people who paid nothing for health care consumed 30 percent more care than those with high deductibles. This is not done in bad faith: patients and their physicians evaluate whether the care is of sufficient value to the patient to be worth the out-of-pocket costs.

This is why Kate (and I, having learned from Kate) talks about “high value health care.” As a policy matter, we should not want to encourage people to use either more or less health care. We should instead want people to be free to choose high value health care without distortion, in which each person decides how to get the greatest value per dollar spent and what is the right balance of improved quality and higher cost.

Everything that I have explained so far about third party payment in health care contributes primarily to a high level of health spending. None of these factors alone, however, explain the extraordinary growth of health spending. This is where we grasp the rose by the thorn: the primary driver of long-term health care cost is technology. America spends more on health care each year primarily because we demand more and better health care each year. We just don’t know that we’re demanding it, because government policies push us toward high-premium low-deductible health insurance that increases our demand for high-quality but low-value technology improvements.

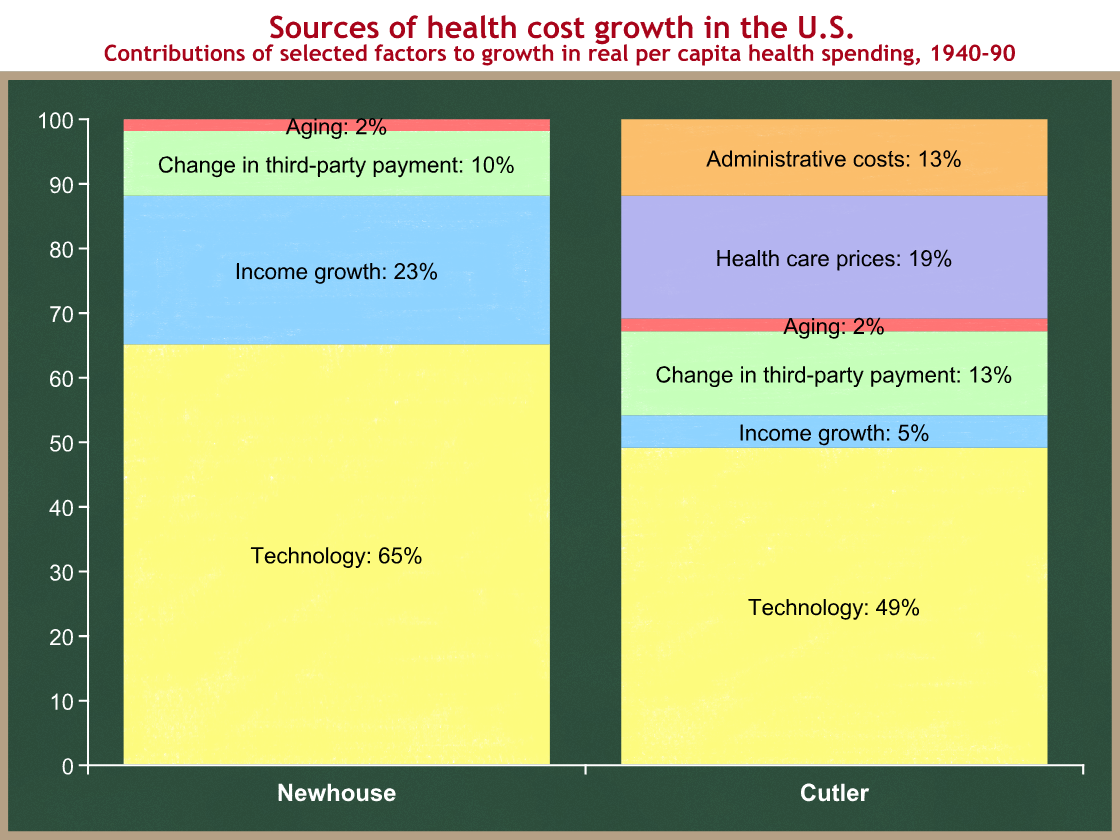

In January of 2008, the Congressional Budget Office reviewed three studies of the sources of cost growth in real per capita health care spending in the U.S. Here is their summary of two of the studies in chart form. (The third study had ranges and was too difficult to graph. It assigned a range for technology of between 38% and 62%.)

You can see that technology explains half to two-thirds of the long-term growth in real per capita health spending. Another 10-13% is the direct result of changes in third-party payment that further insulate us from the cost of the medical care we use (mostly the creation of Medicare and Medicaid).

There are two points here:

- Our employer-based health insurance system hides the cost of premiums and subsidizes those premiums. This encourages those with employer-provided health insurance to ignore some of the higher premium costs, and pushes us toward policies with low deductibles and copayments (at the expense of higher hidden subsidized premiums). These low deductible policies encourage us to use low value health care and result in unsustainably high and rapidly growing insurance premiums that crowd out wage growth.

- These low deductible policies also reduce our sensitivity to the costs of new medical technologies. We choose improved technology without proper regard for whether that technology is worth the higher cost, because government policies are distorting our decisions.

According to the two studies shown above, the interaction of these two factors is responsible for 2/3 to 3/4 of health care cost growth. This is where we get to the politically uncomfortable part.

- Health care costs are on an unsustainable path. We must slow the growth of those costs.

- 2/3 to 3/4 of health care cost growth comes from policies that push us toward low deductible policies and cause us to demand technology improvements without much consideration of the cost of those improvements.

- Any solution that addresses the “change in third-party payment” source of cost growth will mean that people pay more out-of-pocket when they go to the doctor or hospital. In exchange they will get lower premiums. Still, this higher out-of-pocket spending is higher for some politicians to swallow (especially Democrats).

- Any solution that addresses the technology source of health care cost growth will mean that new medical technologies will be developed less rapidly.

Nobody in Washington wants to tell you that last point. We argue about administrative costs, about medical liability costs, about insurance company profits, and about waste, fraud, and abuse. All of those are important contributing factors to high levels of health spending, and we should definitely make reforms that try to lower those levels. But our long-term problem is principally about the growth rate, and addressing the growth rate involves a real tradeoff. New medical technologies and drugs will still be developed, but not quite at the breakneck rate that we’re used to. This is grasping the rose by the thorn.

The only question left then becomes who will make those determinations. Should determinations of “high value health care”and “high value technology improvements” be made by the government, or as the result of the decisions of millions of Americans acting independently based on their own preferences?

You can probably guess my answer.